Making a bank transfer? Here's what's different

Changes came into effect on Monday, May 20th. See the images and learn what has changed.

© Shutterstock

Economia Banca

As transferências bancárias entre contas portuguesas started on Monday, May 20, to require prior confirmation of the beneficiary before the final money transfer order is given.

According to the Banco de Portugal (BdP), "the beneficiary/debtor confirmation features are available 24 hours a day, 7 days a week, 365 days a year, since May 20, 2024".

What's different?

According to the banking supervisor, there are two features for beneficiary/debtor confirmation:

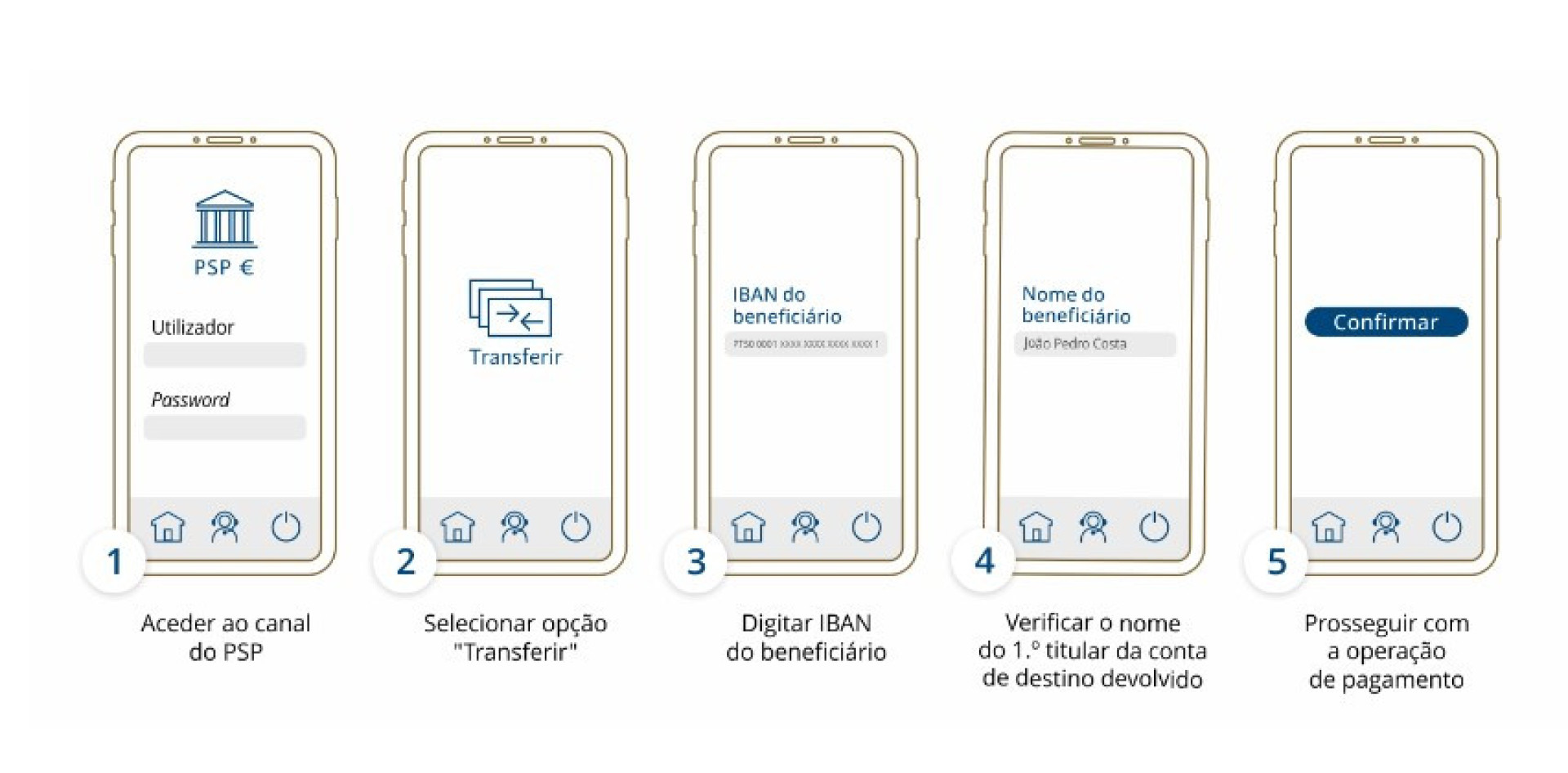

- The individual beneficiary confirmation feature, which allows you to confirm the information about the beneficiary of a transfer, whether on credit or immediate, returning the name of the first holder of the payment account associated with the indicated IBAN;

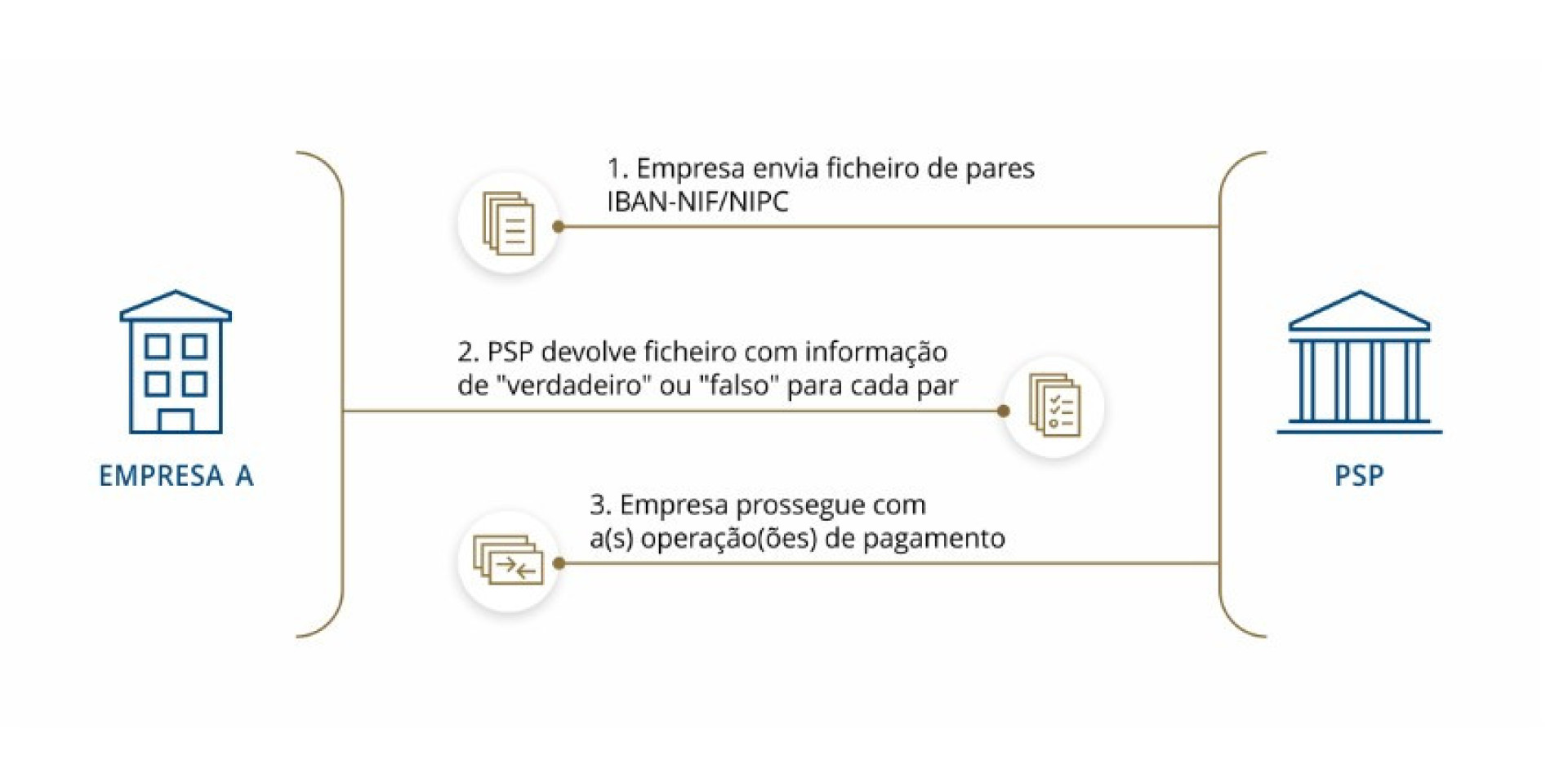

- The grouped beneficiary/debtor confirmation feature, which allows you to confirm the ownership of one (or more) payment account(s) by validating NIF/IBAN or NIPC/IBAN pairs for credit and immediate transfers and direct debits, initiated in a grouped manner.

Regarding the first, the "feature allows the payment service user to obtain information about the beneficiary of a transfer, whether on credit or immediate, before authorizing its execution, giving greater security to the operation".

In practice, "after entering the IBAN, you will be presented with the name of the first holder of the account to which you intend to make the transfer. If the destination account belongs to a legal person, the corporate name will be returned and, if it exists, the respective trade name".

Individual beneficiary confirmation© Reproduction of the Banco de Portugal website

Individual beneficiary confirmation© Reproduction of the Banco de Portugal website

In the case of the second, "it allows companies to verify the ownership of one (or more) payment account(s), through the validation of NIF/IBAN or NIPC/IBAN data pairs, before initiating credit and immediate transfers and direct debits in a grouped manner".

"To this end, the company submits to its payment service provider a set of pairs composed of the IBAN and the NIF/NIPC of the beneficiaries of the credit and immediate transfers or debtors of direct debits, and will receive, for each pair, information on whether it is true or false", explains the BdP.

In practice, "through this feature, companies will be able to, for example, validate that salary and supplier payments are made to the correct beneficiaries, or that direct debit collections are made to the accounts of the intended debtors".

Grouped beneficiary/debtor confirmation© Reproduction of the Banco de Portugal website

Grouped beneficiary/debtor confirmation© Reproduction of the Banco de Portugal website

Read Also: "More secure and convenient". BdP explains two changes in payments (Portuguese version)

Descarregue a nossa App gratuita.

Oitavo ano consecutivo Escolha do Consumidor para Imprensa Online e eleito o produto do ano 2024.

* Estudo da e Netsonda, nov. e dez. 2023 produtodoano- pt.com